Verdensøkonomien er i alvorlig trøbbel. Så mye er opplagt ved inngangen til 2016. Nye data om handelstrafikken til sjøs tyder på at problemene er langt alvorligere enn det som foreløpig er rapportert.

Det later til at handelstrafikken til sjøs nærmest har stoppet opp.

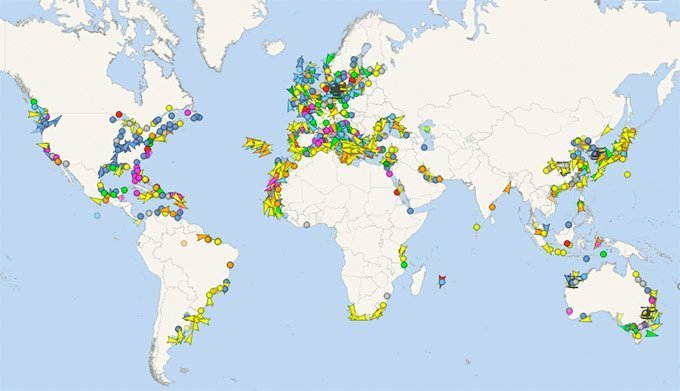

Det finnes en lang rekke nettsider som overvåker skipstrafikken. Dermed kan man til enhver tid se hvilke transportskip som befinner seg hvor. Man kan for eksempel se hvor mange frakteskip som er på vei mellom USA og Europa, og som en rapport sier:

Commerce between Europe and North America has literally come to a halt. For the first time in known history, not one cargo ship is in-transit in the North Atlantic between Europe and North America. All of them (hundreds) are either anchored offshore or in-port. NOTHING is moving.

This has never happened before. It is a horrific economic sign; proof that commerce is literally stopped.

Jeg er ingen ship spotter, men jeg har sjekket marinetraffic.com og vesselfinder.com, og det later til at denne rapporten er nokså riktig. Det ser ikke ut til å være noen handelsskip på de åpne hav per 13.01.2015. Alle skip befinner seg ved eller langs kystene, og bare noen få ser ut til å være på vei noe sted.

Det finnes noe som heter Baltic Dry index. Den er «en bedømmelse av prisen for å flytte store råvarer til sjøs». Per 13. januar 2016 ligger den på sitt laveste nivå noensinne. Indeksen er 402, mens den på sitt aller laveste under finanskrisa var så vidt under 700. Forrige bunnrekord var i 1984, da lå den på ca. 550. Dette bekrefter altså dataene for skipstrafikken. Fabrikker kjøper ikke og handelsselskaper kjøper ikke.

St. Louis fed følger de fleste økonomiske indikatorer for å gi investorene noe å gå etter, og deres oversikt over lagerindeksen i USA (egentlig forholdet mellom lager og salg), og den viser at sist gang lagrene var så fulle var i oktober 2008, da finanskrisa slo til for fullt.

oss 100 kroner!

oss 100 kroner!